May 13, 2016 // WorkLife Wisdom: Ensure Mom and Dad Have the Care They Need

As you look back at the many years your parents cared for you, consider the possibility that someday they may require care themselves. Long-term care insurance can help ensure your parents will receive the care she or he needs, should there come a time when they require help managing some of the activities associated with independent living.

The reality

Millions of Americans require long-term care at some point during their lifetime1, which includes assistance with simple tasks like bathing, eating, and dressing —trivial things we do every day without a second thought. In reality, the type of care needed to provide assistance with these activities can be expensive and is generally not covered by traditional health plans or Medicare.

It’s also important to keep in mind that women, in general, live longer than men. This means women may be more likely to need care at some point in their lives than their male counterparts2.

Take a closer look

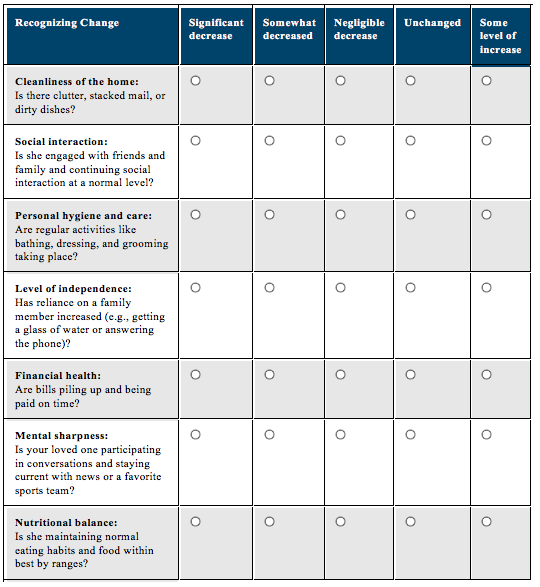

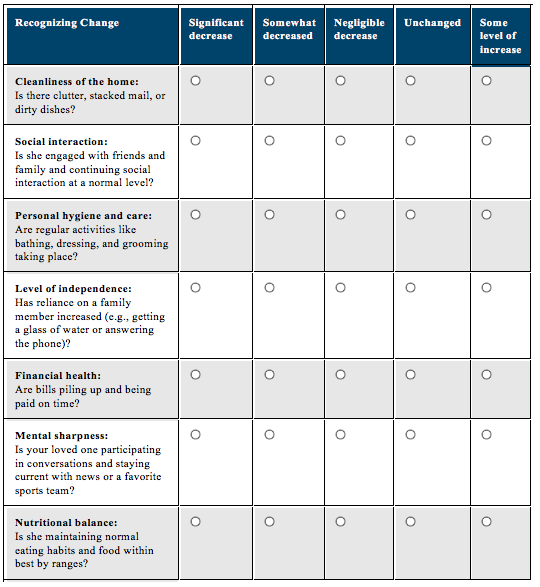

When visiting parents this year, pay attention to some common behaviors that can help you determine whether she or he is having difficulty performing everyday activities. It’s important not to focus on the behavior itself, but rather the change in that behavior compared to what is considered normal. Noticing changes in behavior that may be due to an emerging physical or cognitive impairment is an important first step.

Based on what you observe, the Federal Long Term Care Insurance Program (FLTCIP) may be worth considering when developing your family’s plan for long term care:

How did you answer?

Mostly unchanged

The best time for you and your family members to consider long-term care insurance is long before it’s needed. Because the FLTCIP is medically underwritten, it’s important to apply while you are in good health to avoid the risk that a future illness or condition may prevent you from obtaining coverage. Also, premiums are directly related to age. This means the younger you are when you apply for coverage, the lower your premium.

Recognized changes

If you’re already a FLTCIP enrollee and recognize some of these behavioral changes in a loved one, contact a FLTCIP care coordinator at the phone number provided below to gather important information about the different care options that may be available. The FLTCIP, unlike most long-term care insurance plans, provides certain care coordination services to qualified relatives of enrollees at no cost. A call to one of our care coordinators can provide valuable information such as an assessment of need, direction on developing a plan for long term care services, and access to discounted services and providers, where available.

FLTCIP eligibility

Many members of the Federal family are eligible to apply for coverage under the FLTCIP, including Federal and U.S. Postal Service employees and annuitants, as well as active and retired members of the uniformed services. Qualified relatives such as spouses, domestic partners, parents and parents-in-law, and adult children are also eligible to apply. For a complete eligibility list, visit www.LTCFEDS.com/eligibility.

To learn more about the FLTCIP, visit www.LTCFEDS.com. For personalized assistance, call 1-800-LTC-FEDS (1-800-582-3337) TTY 1-800-843-3557 to speak with a program consultant. Our consultants are available to answer any questions you may have and can walk you step-by-step through the plan design and application process.

Your FAA WorkLife Solutions Program offers Geriatric Care Management Services that include a free in-depth assessment by a geriatric care professional at your aging relative’s current residence.

The consultant will assess the following:

- The medical, physical, psychological, and cognitive functioning of the older person.

- The safety and security of the elderly person’s living environment.

- The person’s ability to take care of his or her basic needs. (eating, bathing, getting dressed, transportation to appointments, etc.)

- The person’s current social support network. (family members, friends, caregivers)

- Any unique challenges the person faces.

The geriatric care professional will then identify areas of risk to the elderly person’s safety, security, or independence; and provide solutions to address the person’s individual needs. Following the assessment, you will receive a comprehensive report outlining your loved one’s needs, the issues of concern, and a plan for implementing recommendations.

To schedule an in-home assessment with a geriatric care professional, call Magellan Health Services at (800) 234-1327 (TTY 800-456-4006).

Learn more about other WorkLife elder care services

In addition to the Geriatric Care Management Services, your WorkLife benefits also include a number of services you can take advantage of:

- Locate an elder care support facility such as a senior center, retirement community, adult day care, or assisted living facility.

- Learn more about aging and adult care issues.

- Learn how to take reduce caregiving stress.

Your WorkLife Solutions Program is available to you and your household members by calling 800-234-1327 (TTY 800-456-4006) 24 hours a day, seven days a week. By using this toll free number, you can log into FAA’s WorkLife Services at www.magellanhealth.com/member.

1Center for Disease Control and Prevention. “Long Term Care Services in the United States,” www.cdc.gov/nchs/data/nsltcp/long_term_care_services_2013.pdf (accessed February 2016).

2U.S. Department of Health and Human Services. “Who Needs Care?,” http://longtermcare.gov/the-basics/who-needs-care/ (accessed February 2016).