May 20, 2016 // This Week’s Notebook: Member in Need, New OSHA Webinar, Member Benefits, and Much More!

NATCA Alaskan Region and National Legislative Committee member Richard “Tiny” Fagg is in need of leave donations through the FAA’s Voluntary Leave Transfer Program (VLTP). He has been caring for his wife, Tammi, who battled and recovered from lung cancer, but now faces treatment and therapy following surgery to remove a tumor on her brain.

Please consider a leave donation to help them if you can, while you’re at your facility.

You may submit donations through the Online VLTP Intranet site. In order to donate leave online, it requires that you have registered with the site. To register for the site, please click on “Request Login” on the left and follow the on-screen instructions. The system will send you a temporary password and asks to reset after you login. Donors must use an FAA computer with Intranet access to donate leave through this process. The donation process is not available through the Internet.

New NATCA OSHA Committee Webinar!

When: May 26, 1 p.m. EDT

What: Roof Replacement Challenges: This webinar describes the process of roof replacement and what we as professionals can do to protect and inform occupants of these challenges.

The roof of a building is important, but like most things, it does not last forever. Roofs can begin to fail in 20 years or so after they are built and that time can be even shorter if they are not maintained properly. When they start to leak it can lead to problems like mold growth.

Roof replacement is a serious construction project. It can potentially expose building occupants to asbestos and volatile organic compounds. It can also expose the building to water infiltration and mold growth if temporary protection between the roof removal and re-roofing is not effective. At the very minimum, it will introduce some new odors inside the building.

What’s New at the NATCA Store? B2P Roller Pen

Go green and try the new NATCA B2P Roller Pen – the world’s first pen made from recycled bottles! Writes with a smooth flow and comes in fine and medium point. It has a crystal blue, see-through barrel with a finger grip for comfort. Sold in packs of 12. Made in the USA.

Price: $17

View the item. To order, select USPS or UPS as your shipping preference on your orders. Reminder: apparel items take three to four weeks to deliver from date of order. If you need items by a certain date, please contact NATCA Store customer service for arrangements. Expedited shipping charges may apply.

To check on stock availability or for further assistance, call 800.266.0895 or email [email protected].

Benefits Spotlight: Cambridge Financial

As air traffic controllers, we are an elite group of men and women with a skill set that the average person cannot even comprehend, let alone perform. Yet, when it comes to the financial aspect of our jobs, like the many different retirement systems, life insurances, TSP, health insurance, the impact the markets, and politics have on our benefits…it can become an overwhelming task to understand and keep track of it all.

Luckily, your membership in the greatest union in the United States earns you the privilege of access to Cambridge Financial Partners, LLC. Cambridge Financial has partnered with NATCA for years to specifically provide you, the member, with access to financial experts whose area of expertise is specifically geared towards you, the air traffic controller, and the federal benefits system.

The staff of Cambridge will help you make sense of all the intricacies and nuances of our complicated federal system, help you understand if there are better choices in the private market for your financial future, and guide you through the stringent requirements of the federal retirement policies. In the private sector, a financial planner wading with you through all the federal financial muck would cost you hundreds of dollars. As a NATCA member, the only thing Cambridge Financial will cost you is some of your time. Contact Cambridge Financial today for a solid financial tomorrow.

Cambridge Corner

Participants who have traditional (non-Roth) contributions in their TSP accounts have not yet paid taxes on both the contributions and the accrued earnings. Taxes will be owed on contributions and earnings when a payment is made from a participant’s account. A participant may continue to defer payment of taxes by transferring or rolling over the payment from a traditional TSP account to a traditional IRA, or an eligible employer plan, such as a 401(k) or 403(b) retirement plan.

Participants who made Roth contributions to their Roth TSP account have already paid taxes on those contributions. A participant with Roth contributions will not pay tax on those contributions when they are withdrawn from a Roth TSP account. The tax treatment of earnings depends on whether the payment is a “qualified distribution”, which means that the entire payment from a Roth account is tax-free.

The earnings in a Roth TSP account become qualified and therefore completely tax-free, when the following two conditions have been met:

- Five years have passed since January 1 of the calendar year in which the Roth TSP participant made his or her first contribution (referred to as the “five year rule”)

- The Roth TSP participant has reached age 59.5, has a permanent disability, or died. Note that a spousal beneficiary of a Roth TSP account may request a qualified distribution when five years have passed since January 1st of the calendar year in which the deceased Roth TSP participant made his or her first Roth contribution to the account.

Call 888-900-4690 or click here for more information on how Cambridge Financial Partners can help you.

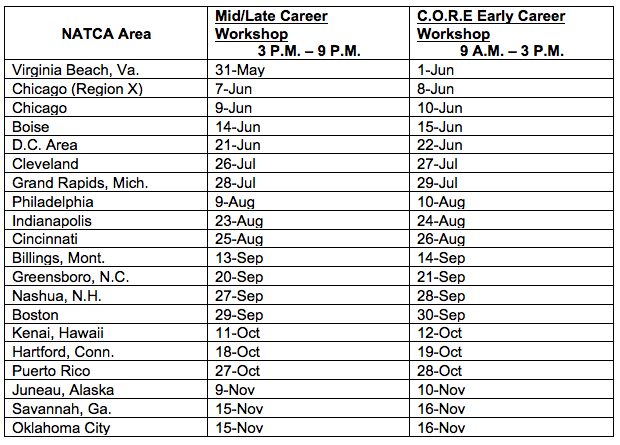

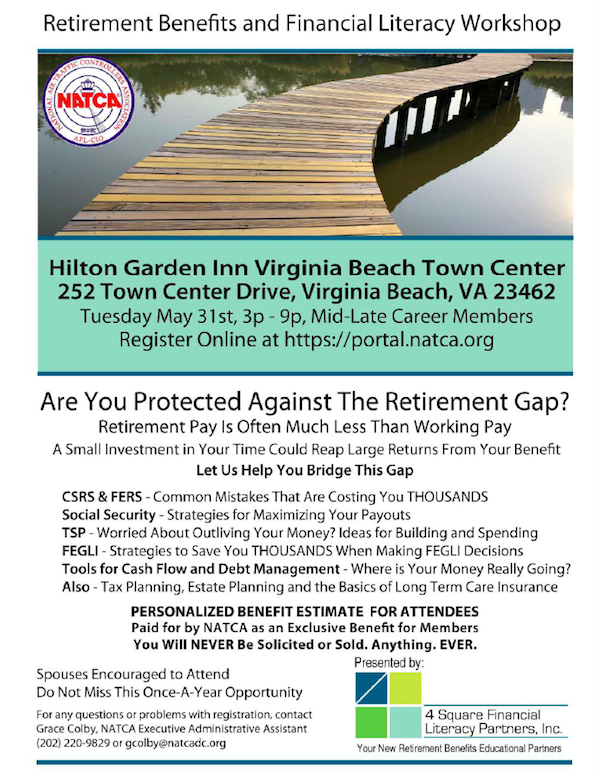

Upcoming Retirement Seminars Provided By 4 Square:

Standard seminar for members with more than 15 years of service held from 3 to 9 p.m. local time.

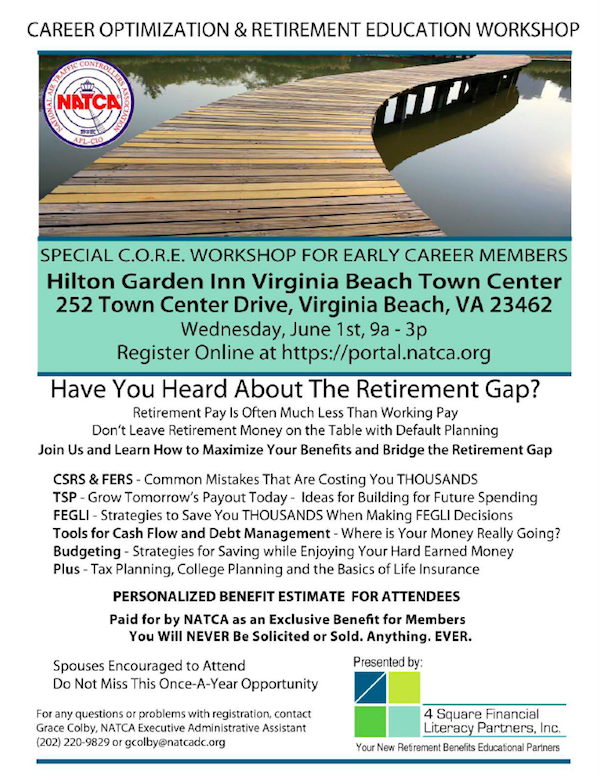

Register by signing on to the NATCA Portal. Please verify the personal information listed for you including email and cell phone number. If any information is incorrect or missing, please correct or add it under the “My Profile” tab.

To register for a seminar, click the “Events” tab, followed by “2016 Retirement Seminars.” Complete the requested information and click “Next”. When you come to the screen listing the seminars, select the one you wish to attend, hit “Next,” verify your requested seminar information and then click “Done.” You will receive a confirmation email that your registration was complete.

A second email will be sent two to three weeks prior to the seminar giving you the logistical information for the seminar. Also included in this email will be instructions on how to obtain a benefits estimate at the seminar.

Spouses and significant others are also invited to attend. Please ensure that you add them to the registration when asked if you will be bringing a guest. Please try to register three weeks prior to the seminar. Walk-ins are permitted to attend as long as they can provide their membership ID number. However, you will be unable to obtain a benefits estimate at the seminar.

For any questions or problems with registration, please contact Grace Colby, NATCA Executive Administrative Assistant: (202) 220-9829, [email protected].

Upcoming Retirement Seminars:

We are now offering Career Optimization and Retirement Education (C.O.R.E.) Seminars in many cities! These seminars are geared towards employees with zero to 15 years of service who want to maximize their retirement benefits and plan for financial stability in retirement. Log in to the Portal today to see which cities are offering this great new program.

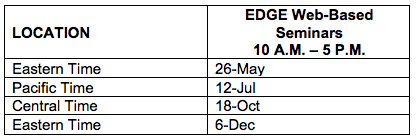

NATCA EDGE – Designed exclusively for NATCA members!

Can’t get to an in-person retirement seminar? We’ll bring the seminar to you!

Presenting an all-new, flexible access, web-based session of our popular retirement benefits seminar:

To register for a session, visit the NATCA Portal. Click “Events” on the menu bar on the home page, then select the “2016 NATCA Edge Online Retirement Webinar” link. Follow the questions and directions from there.

Personalized benefit estimate for participants paid for as an exclusive benefit for NATCA members. You will never be solicited or sold anything, ever!

For any questions or problems with registration, please contact Grace Colby, NATCA Executive Administrative Assistant: (202) 220-9829, [email protected].