Oct. 21, 2016 // This Week’s Notebook: Fall Hoodies, Help Us Update Our Membership Records, Union Plus Credit Card 30th Anniversary Sweepstakes, and Much More!

NATCAStore.com Item of the Week: Hooded Sweatshirt

Features: This sweatshirt is 50 percent cotton and 50 percent polyester. It is made of medium-weight fleece with a double-ply hood, grommets, matching draw cord, and pouch-styled pocket. The NATCA logo is featured on the left front chest.

Available sizes: S-3XL.

Price: $32.

Made in USA.

To see the item and how to order: Select USPS or UPS as your shipping preference on your orders. To check on stock availability or for further assistance, call 800.266.0895 or email [email protected].

2017 Pocket Calendars: How to Receive Yours

Log in to the NATCA Portal for one free copy of the 2017 NATCA Pocket calendar.

Please insure that your mailing information under “My Profile” is correct. Once you have verified the information, click the “Events” tab and make your request under “Request for 2017 Pocket Calendar.” Please make your request no later than Nov. 11. The pocket calendars will be mailed to your residence by mid-December. Bulk orders can be purchased later through the NATCA Store.

Member Portal: Help Us Update Our Membership Records

Have you moved recently and need to update your mailing address? No problem! Simply log in at the Member Portal and update your contact information. Those registering for the first time must have your NATCA member number ready as it is needed when you register. For further assistance, contact Customer Service at 800-266-0895 or email [email protected].

To obtain your member number via the Portal, please click here.

Benefits Spotlight: SkyOne Offers Great Services for NATCA Members!

Are you looking for a bank that understands your needs? Perhaps a more personalized banking experience? SkyOne Federal Credit Union offers this and much more to thousands of air transportation employees, their families, and even other members of their household. SkyOne understands your career and lifestyle and even provides relief in the event of layoffs or furloughs. Some of the services offered are:

- Checking accounts

- Savings accounts

- Certificates

- IRA’s

- Money Market Accounts

- Auto loans

- Personal loans

- Credit cards

- Mortgage

- Insurance

- Home Equity Loans

- And much more!

In addition to the services listed above, SkyOne gives complimentary consultations regarding: Thrift Savings Plans (TSP), Civil Service Retirement System (CSRS), Federal Employee Retirement Systems (FERS), Federal Group Life Insurance (FEGLI), and Federal Employee Long Term Care Insurance Program (FELTCIP). Complimentary seminars on financial planning are also offered.

SkyOne goes above and beyond to fit your personal, professional or even your local NATCA needs. Check them out at www.skyone.org. Let SkyOne make your life easier. It will change the way you think about banking!

Union Plus Credit Card Program: Celebrating 30th Anniversary With Sweepstakes Offer

In celebration of the 30th Anniversary of Union Plus and the Union Plus Credit Card program, Capital One has planned a substantial sweepstakes campaign around rewarding the approximately one million cardholders and members of unions that participate in the card program. It’s the program’s first campaign aimed at cardholders since Capital One has been the program provider.

The sweepstakes runs Oct. 10, 2016, to Dec. 31, 2016, and is open to any Union Plus cardholder or non-cardholders who belong to a union that participates in the Union Plus Credit Card program.

At the September 2016 Liaison Lunch and Learn, many of you asked for materials to help you promote the Sweeps to your members. For more information, please click here.

Cambridge Corner: Roth TSP

Participants who have traditional (non-Roth) contributions in their TSP accounts have not yet paid taxes on both the contributions and the accrued earnings. Taxes will be owed on contributions and earnings when a payment is made from a participant’s account. A participant may continue to defer payment of taxes by transferring or rolling over the payment from a traditional TSP account to a traditional IRA, or an eligible employer plan, such as a 401(k) or 403(b) retirement plan.

Participants who made Roth contributions to their Roth TSP account have already paid taxes on those contributions. A participant with Roth contributions will not pay tax on those contributions when they are withdrawn from a Roth TSP account. The tax treatment of earnings depends on whether the payment is a “qualified distribution”, which means that the entire payment from a Roth account is tax-free.

The earnings in a Roth TSP account become qualified and therefore completely tax-free, when the following two conditions have been met:

- Five years have passed since Jan. 1 of the calendar year in which the Roth TSP participant made his or her first contribution (referred to as the “five year rule”); and;

- The Roth TSP participant has reached age 59.5, has a permanent disability, or died. Note that a spousal beneficiary of a Roth TSP account may request a qualified distribution when five years have passed since Jan. 1 of the calendar year in which the deceased Roth TSP participant made his or her first Roth contribution to the account.

Call 888-900-4690 or click here for more information on how Cambridge Financial Partners can help you.

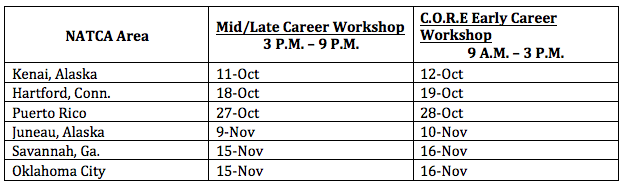

Upcoming Retirement Seminars Provided By 4 Square:

Standard seminar for members with more than 15 years of service held from 3 to 9 p.m. local time.

Register by signing on to the NATCA Portal. Please verify the personal information listed for you including email and cell phone number. If any information is incorrect or missing, please correct or add it under the “My Profile” tab.

To register for a seminar, click the “Events” tab, followed by “2016 Retirement Seminars.” Complete the requested information and click “Next.” When you come to the screen listing the seminars, select the one you wish to attend, hit “Next,” verify your requested seminar information and then click “Done.” You will receive a confirmation email that your registration was complete.

A second email will be sent two to three weeks prior to the seminar giving you the logistical information for the seminar. Also included in this email will be instructions on how to obtain a benefits estimate at the seminar.

Spouses and significant others are also invited to attend. Please ensure that you add them to the registration when asked if you will be bringing a guest. Please try to register three weeks prior to the seminar. Walk-ins are permitted to attend as long as they can provide their membership ID number. However, you will be unable to obtain a benefits estimate at the seminar.

For any questions or problems with registration, please contact Grace Colby, NATCA Executive Administrative Assistant: (202) 220-9829, [email protected].

We are now offering Career Optimization and Retirement Education (C.O.R.E.) Seminars in many cities! These seminars are geared towards employees with zero to 15 years of service who want to maximize their retirement benefits and plan for financial stability in retirement. Log in to the Portal today to see which cities are offering this great new program.

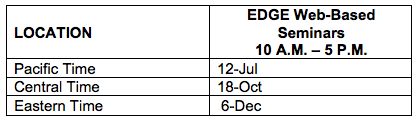

NATCA EDGE – Designed exclusively for NATCA members!

Can’t get to an in-person retirement seminar? We’ll bring the seminar to you!

Presenting an all-new, flexible access, web-based session of our popular retirement benefits seminar:

To register for a session, visit the NATCA Portal. Click “Events” on the menu bar on the home page, then select the “2016 NATCA Edge Online Retirement Webinar” link. Follow the questions and directions from there.

Personalized benefit estimate for participants paid for is an exclusive benefit for NATCA members. You will never be solicited or sold anything, ever!

For any questions or problems with registration, please contact Grace Colby, NATCA Executive Administrative Assistant: (202) 220-9829, [email protected].